This article, by Marc Joffe and Ian MakGill, originally appeared on the Guardian website on 01 August 2013. Marc Joffe will be speaking in the Open Finance and OpenSpending – Workshop on Wednesday 18 September, 14:45 – 16:00 @ Room 7, Floor 2.

Open governance groups around the world compare local authority finances

Council finances are being compared for greater transparency, but a lack of standardised data is holdings things back.

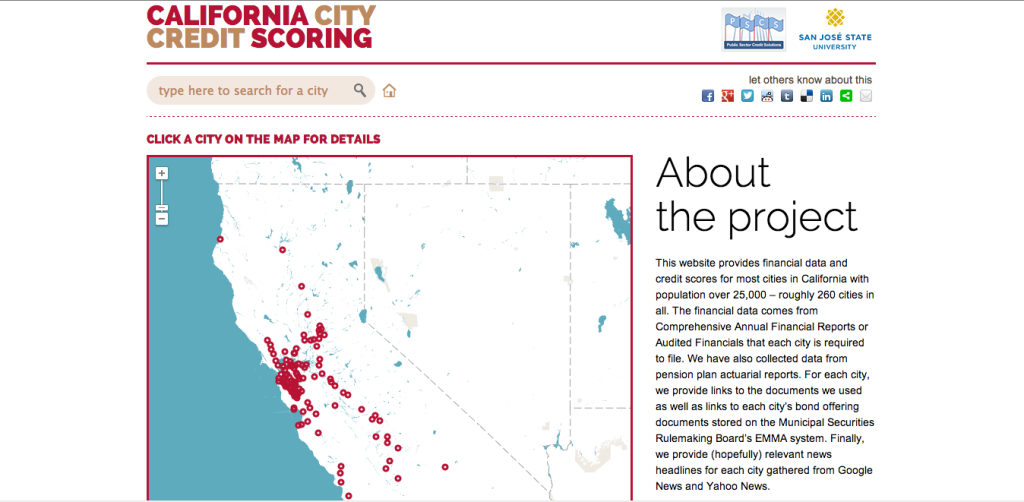

We built a website in the US that maps the finances and credit scores of 260 Californian cities. You can click on a town and find out about their revenues and expenditure, debt levels and even retirement plans for staff.

The California fiscal transparency project is one example of how open governance initiatives are increasingly being used to compare local authorities, accessing their spending priorities and financial conditions. A similar site exists in Denmark and one will launch in Israel shortly using a new open source software platform.

However, projects like this that compare authorities finances face a number of challenges – many of which arise from a lack of standardised, machine-readable data. While corporate financial data analysis is aided by the XBRL standard, there is no analogous standard in the realm of government financial reporting.

Our work on California required us to locate and extract data from audited financial reports filed by each city. In virtually all cases, these reports were stored in pdf files, and completing this project required a lot of manual inputting. We got the best results by selecting portions of the pdf to convert within the software.

So, would something like this be possible in England? The raw material for such a project is available in abundance. Local councils in England are required to publish audited financial accounts, and typically do so in pdf form. Tax receipts, investments and borrowing data for all councils are published in Excel format by the Department for Communities and Local Government.

But it is not certain whether these statistics tie out to the audited financial reports. In California, we found widespread inconsistencies between audited financial reports and standardised data collected by the state controller’s office. The Chartered Institute for Public Finance and Accounts also collects and standardises council financial data, but they sell their compilations for several hundred pounds.

The UK is significantly ahead of the US in the area of reporting transactions. In the UK, councils are required to publish all transactions above £500; some voluntarily report smaller transactions.

The only problem is that there are varying interpretations of what data is being completed in each field and inconsistency in data formats and field headers. Although transaction reports are supposed to be issued monthly, some councils publish them less frequently.

While most councils provide their spending data in machine readable formats, others only provide pdfs. We sent a freedom of information request to East Riding council, asking them to publish their data in comma separated variable (CSV) format instead but the council refused on the basis that the data in the new format might be used fraudulently.

Some of the local government transaction data has been aggregated on the Open Knowledge Foundation’s global Open Spending project and at Openly Local.

City councils in the US and the UK both publish budgets which include estimates of future spending. In our California project, we initially excluded budgets because budget reporting formats are less consistent than those used in audits (since the latter are governed by accounting standards).

However, because budgets are forward looking, citizens find them more interesting. As a result, they have been the focus of the Denmark effort as well as many individual city-level transparency projects such as Open Oakland.

In California, the impetus for developing our transparency site was a desire to provide an alternative to credit ratings for assessing the likelihood of municipal bond defaults. In recent years, the state has had a number of high-profile bankruptcies, so investors may require greater transparency before purchasing bonds issued by California cities. We meet this need by running city financial statistics through an open source credit scoring model.

UK councils have not accessed the capital markets, but that could be about to change. Before becoming reliant on the credit rating agencies, local leaders may wish to build a transparency platform like the one in California.

Marc Joffe is the principal consultant at Public Sector Credit Solutions and Ian Makgill is the managing director of the Spend Network.

This post is by a guest poster. If you would like to write something for the Open Knowledge Foundation blog, please see the submissions page.

The link to the Danish example fails. the correct one is: http://kommune.politiken.dk/